Piper Sandler Completes 39th Semi-Annual Generation Z Survey of 5,200 U.S. Teens

- Overall teen “self-reported” spending decreased by 13% Y/Y & 4% sequentially to

$2 ,300—the lowest level since fall 2011 - Food continues to be teen’s No. 1 wallet priority at 25% share

- Teens care about social/political issues naming the Environment as No. 1; Coronavirus took the No. 2 spot

- 47% of teens believe the economy is getting worse—vs. 32% in Fall 2019 & 28% in Spring 2019

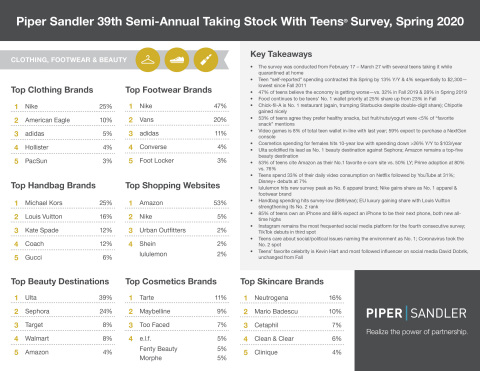

- Athletic brands dominate fashion preferences with notable gains in lululemon (No. 6 apparel brand) and Nike (No. 1 apparel and footwear brand)

- TikTok makes survey debut as No. 3 most used social media platform, surpassing Twitter, Facebook and Pinterest

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200408005477/en/

TSWT Spring 20 Infographic (Graphic:

This year’s Spring 2020 survey was impacted by the COVID-19 pandemic. The survey was conducted from

For the survey infographic and more information, visit pipersandler.com/teens

“Our

“Today’s teens are more connected than ever before—they spend an average of 12 hours on social media per week, 53% name Amazon as their top e-commerce site, Netflix is their go-to choice for daily content & 85% own an iPhone. As it relates to brand preferences, we continue to see casualization of fashion march higher—Nike gained share as the No. 1 brand & lululemon hit a new survey high as the No. 6 preferred brand.”

Spring 2020 Key Findings

Spending & Shopping Behavior

- Food continues to be teens’ No. 1 spending category at 25% of wallet share, up from 23% in Fall 2019

- Amazon continues to climb as teens’ No. 1 preferred online shopping mindshare at 53% —10x higher than the No. 2 ranking, Nike

- Cosmetics spending for females hits 10-year low with spending down 26% Y/Y to

$103 /year - 78% of female teens use online influencers as a source of discovery for beauty brands and trends

- Teens indicated they spend an average of

$89 /year on handbags — a new survey low and compares to peak spending of$197 /year (Spring 2006) - Average video game spend by teens over the past 15 surveys is

$197

Brand Preferences

- Chick-fil-A remains No. 1 restaurant for 5 surveys; Starbucks retains double-digit share

Kellogg most preferred snack brand among teens- Ulta maintains No. 1 preferred beauty destination against

Sephora for third survey in a row - Netflix surpasses YouTube as No. 1 daily video consumption; Disney+ debuts in top 5 ahead of Amazon and Apple TV+

- 85% of teens own an iPhone and 88% expect an iPhone to be their next phone, both new all-time survey highs

The Piper Sandler Taking Stock With Teens® survey is a semi-annual research project that gathers input from 5,200 teens with an average age of 16.2 years. Discretionary spending patterns, fashion trends, technology, and brand and media preferences are assessed through surveying a geographically diverse subset of high schools across the

* Source: Fung Global Retail & Technology

ABOUT

©2020. Since 1895. Piper Sandler Companies.

View source version on businesswire.com: https://www.businesswire.com/news/home/20200408005477/en/

Tel: 612 303-8185

pamela.steensland@psc.com

Source: Piper Sandler Companies