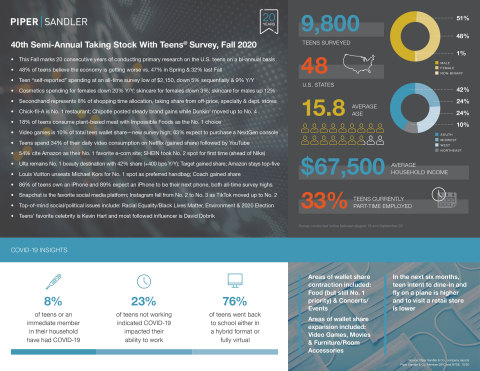

Piper Sandler Completes 40th Semi-Annual Generation Z Survey of 9,800 U.S. Teens

- This Fall

marks 20 consecutive years of conducting primary research onU.S. teens on a semi-annual basis - Overall teen “self-reported” spending reaches an all-time survey low of

$2,150 , down by 9% Y/Y & 5% sequentially - 48% of teens believe the economy is getting worse—vs. 47% in Spring 2020 & 32% in Fall 2019

- Teens care about social/political issues naming Racial Equality as No. 1 & the Environment as No. 2; the 2020 Election moves up to No. 4

- TikTok climbs to No. 2 top social media platform surpassing Instagram but behind

Snapchat ; teens reported spending 12 hours/week on social media - Athletic brands dominate fashion preferences with notable gains in Nike (No. 1 apparel & footwear brand) & lululemon at No. 6

- Food ties with Clothing as the No. 1 priority in the teen wallet; Video Games now represents 17% of upper-income male spend—a new all-time high

COVID-19 Teen Spending & Shopping Behavior Insights

- In the next six months, teens intent to dine-in & fly on a plane is higher, intent to visit a retail store is lower

- 33% of teens are currently part-time employed—this is down from 37% in Spring & 35% last Fall

- 76% teens went back to school either in a hybrid format or fully virtual this Fall

Piper Sandler Companies (NYSE: PIPR), a leading investment bank and institutional securities firm, completed its 40th semi-annual Taking Stock With Teens® survey in partnership with DECA. This survey highlights discretionary spending trends and brand preferences from 9,800 teens across 48 U.S. states with an average age of 15.8 years. Generation Z, which contributes approximately

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20201006005478/en/

Piper Sandler TSWT Fall 2020 infographic (Graphic: Business Wire)

This year’s Fall 2020 survey was impacted by the COVID-19 pandemic. The survey was conducted from

For the survey infographic and more information, visit pipersandler.com/teens.

“Our Fall survey gave rise to some fascinating takeaways as consumers are adjusting to a new normal—47% of students came back to school virtually this year and another 29% of our respondents are back-in-school in a hybrid format. While we are not surprised that overall teen spending was down again given the economic backdrop, we are seeing wallet share priorities change including increased share for video games & furniture/room accessories and decreased share for food & concerts/events.

“TikTok, now the No. 2 preferred social media platform behind

“One distinguishing feature of GenZ is that they are a generation that cares about social justice. Racial Equality/

Fall 2020 Key Findings

Spending & Shopping Behavior

- Areas of wallet share contraction included: Food (still No. 1 priority) and Concerts/Events

- Areas of wallet share expansion included: Video Games, Movies & Furniture/Room Accessories

- Amazon remains teens’ No. 1 preferred online shopping mindshare at 54% but SHEIN takes No. 2 spot for the first time (ahead of Nike)

- Skincare spending eclipses cosmetics spending for the first time ever among females; skincare for females was only down 3% & skincare for males was up 12%

- 84% of female teens rely on influencers as a source of discovery for beauty brands & trends

- Video games hold 10% of total teen wallet share—new survey high; 63% expect to purchase a NextGen console

- Secondhand represents 8% of shopping time allocation, taking share from off-price, specialty & department stores; Thrift ranked No. 13 as a preferred apparel brand/retailer vs. No. 44 last year

Brand Preferences

- Chick-fil-A remains No. 1 restaurant; Chipotle gains share & Dunkin’ Donuts moves up to No. 4

- 18% of teens consume plant-based meat with

Impossible Foods as the No. 1 choice - Lays is most preferred snack brand among teens

- Ulta maintains No. 1 preferred beauty destination against

Sephora for fourth survey in a row - e.l.f. climbs to the No. 2 cosmetics brand from No. 4 last year—a new survey high

- CeraVe climbs to No. 1 skincare brand at a staggering 28% share, surpassing Neutrogena

- Teens spend 34% of their daily video consumption on Netflix, followed by YouTube

- 86% of teens own an iPhone and 89% expect an iPhone to be their next phone, both new all-time survey highs

The Piper Sandler Taking Stock With Teens® survey is a semi-annual research project that gathers input from 9,800 teens with an average age of 15.8 years. Discretionary spending patterns, fashion trends, technology, and brand and media preferences are assessed through surveying a geographically diverse subset of high schools across the

* Source: Fung Global Retail & Technology

ABOUT

©2020. Since 1895. Piper Sandler Companies.

View source version on businesswire.com: https://www.businesswire.com/news/home/20201006005478/en/

Tel: 612 303-8185

pamela.steensland@psc.com

Source: Piper Sandler Companies