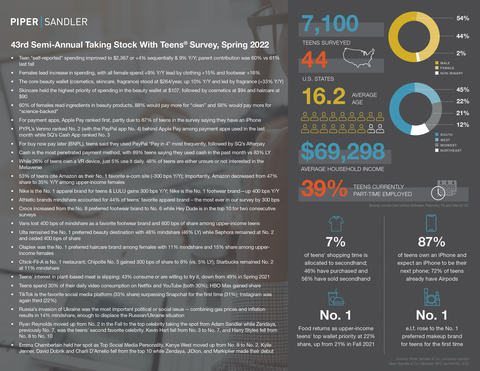

Piper Sandler Completes 43rd Semi-Annual Generation Z Survey of 7,100 U.S. Teens

- Over 21 years of research on

U.S. teens and GenZ insights - Overall teen “self-reported” spending increased slightly to

$2,367 per year; seeing emergence of female-led spending cycle led by apparel - Food returns to upper-income teens’ No. 1 wallet priority at 22% share, up from 21% in Fall 2021 but down from 23% LY

- Teens care about social/political issues naming Russia’s invasion of the

Ukraine as No. 1 & Environment as No. 2; Racial Equality as No. 3 TikTok surpassesSnapchat as the No. 1 (33%) favorite social media platform, followed bySnapchat (31%); Instagram loses share as the No. 3 player- Nike is No. 1 apparel brand for teens and LULU gains 300 bps Y/Y; Nike is the No. 1 footwear brand—up 400 bps Y/Y

- Skincare held the highest priority of spending in the beauty wallet at

$107 , followed by cosmetics at$94 and haircare at$90 - 53% of teens cite Amazon as their No. 1 favorite e-com site (-300 bps Y/Y); Importantly, Amazon decreased from 47% share to 35% Y/Y among upper-income females

- 39% of teens hold a part-time job – up from 38% last fall and 33% in spring 2021

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220406005379/en/

(Graphic: Business Wire)

This year’s Spring 2022 survey was conducted from

For the survey infographic and more information, visit pipersandler.com/teens

“Our Spring survey showed an acceleration in overall teen spending, up 9% Y/Y. Of note, females continue to lead the growth in not only fashion spending (clothing +15%, Footwear +16%), but also continue to lead in the shift to digital with 95% of upper-income females shopping online vs 91% of males. Additionally, the core beauty wallet (cosmetics, skincare, fragrance) stood at

“GenZ is known to be a conscious generation, and teens this Spring cited the Russian invasion of

“Teens continue to spend roughly four hours a day on social media as

Spring 2022 Key Findings

- Teens allocate 7% of their shopping time to secondhand; 46% of teens have purchased & 56% have sold secondhand

- The core beauty wallet (cosmetics, skincare, fragrance) stood at

$264 /year, up 10% Y/Y and led by fragrance (+33% Y/Y) - 60% of females read ingredients in beauty products. 88% would pay more for “clean” and 58% would pay more for “science-backed”

- For payment apps, Apple Pay ranked first, partly due to 87% of teens in the survey saying they have an iPhone

- PYPL’s Venmo ranked No. 2 (with the PayPal app No. 4) behind Apple Pay among payment apps used in the last month while SQ’s Cash App ranked No. 3

- For buy now pay later (BNPL), teens said they used PayPal “Pay in 4” most frequently, followed by SQ’s Afterpay

- Cash is the most penetrated payment method, with 89% teens saying they used cash in the past month vs 83% LY

- While 26% of teens own a VR device, just 5% use it daily. 48% of teens are either unsure or not interested in the Metaverse

- Athletic brands mindshare accounted for 44% of teens’ favorite apparel brand – the most ever in our survey by 300 bps

- Crocs increased from the No. 8 preferred footwear brand to No. 6 while Hey Dude is in the top 10 for two consecutive surveys

- Vans lost 400 bps of mindshare as a favorite footwear brand and 600 bps of share among upper income teens

- e.l.f. rose to the No. 1 preferred makeup brand for all teens for the first time–-gaining 300 bps Y/Y and displacing

Maybelline - Ulta remained the No. 1 preferred beauty destination with 48% mindshare (46% LY) while

Sephora remained at No. 2 and ceded 400 bps of share - Olaplex was the No. 1 preferred haircare brand among females with 11% mindshare and 15% share among upper-income females

Chick-Fil-A is No. 1 restaurant; Chipotle No. 3 gained 300 bps of share to 8% (vs. 5% LY); Starbucks remained No. 2 at 11% mindshare- Teens’ interest in plant-based meat is slipping; 43% consume or are willing to try it, down from 49% in Spring 2021

- 87% of teens own an iPhone and 87% expect an iPhone to be their next phone; 72% of teens already have AirPods

- Teens spend 30% of their daily video consumption on Netflix and YouTube (both 30%); HBO Max gained share

The Piper Sandler Taking Stock With Teens® survey is a semi-annual research project that gathers input from 7,100 teens with an average age of 16.2 years. Discretionary spending patterns, fashion trends, technology, and brand and media preferences are assessed through surveying a geographically diverse subset of high schools across the

ABOUT

Follow

View source version on businesswire.com: https://www.businesswire.com/news/home/20220406005379/en/

Tel: 612 303-8185

pamela.steensland@psc.com

Source: