History

A proud legacy of powerful partnerships

Since 1895, Piper Sandler has been a leading financial services company committed to delivering integrity, insight and impact to each and every relationship. Collaboration and candor have always been and still remain the cornerstones of our promise to clients and to one another—enabling us to inspire confidence by exceeding expectations.

1895

George Lane establishes George B. Lane, Commercial Paper and Collateral Loans & Co., a commercial paper brokerage, in Minneapolis. Lane offered promissory notes to businesses, focusing on Minnesota’s growing grain elevator and milling industries.

1913

H.C. Piper Sr. and C.P. Jaffray establish their own commercial paper business called Piper, Jaffray & Co.

1914

F.P. Hopwood and his son, Robert Gaddis Hopwood, introduce Hopwood Investment Co., which specializes in mortgage loans, real estate and insurance.

1917

George B. Lane & Co. merges with Piper, Jaffray & Co. to form Lane, Piper & Jaffray, brokers of commercial paper securities.

1929

The stock market crash hits Hopwood & Company hard, while Lane, Piper & Jaffray, which hasn’t yet traded listed securities, is not directly affected. Piper Jaffray & Hopwood is formed and the new firm gains a seat on the New York Stock Exchange.

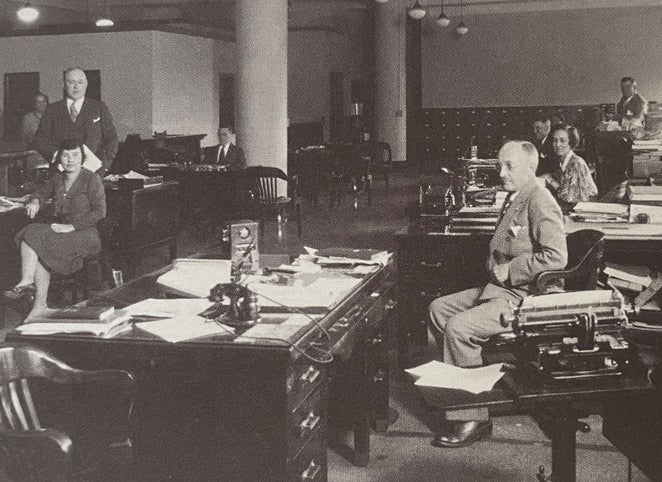

1944

Nearly 50 years since its inception in Minneapolis, Piper Jaffray & Hopwood begins its expansion westward, opening an office in Great Falls, Mont.

1964

By the mid-60s, the company has not only acquired another entity, Jamieson & Company, it has added eight offices.

1967

Harry Piper Jr. becomes chairman of the directing partners of Piper Jaffray & Hopwood. Two years later he becomes chairman of the board and CEO.

1971

The firm becomes the first regional brokerage firm to offer its own stock for public sales. Investors buy 300,000 shares of common stock.

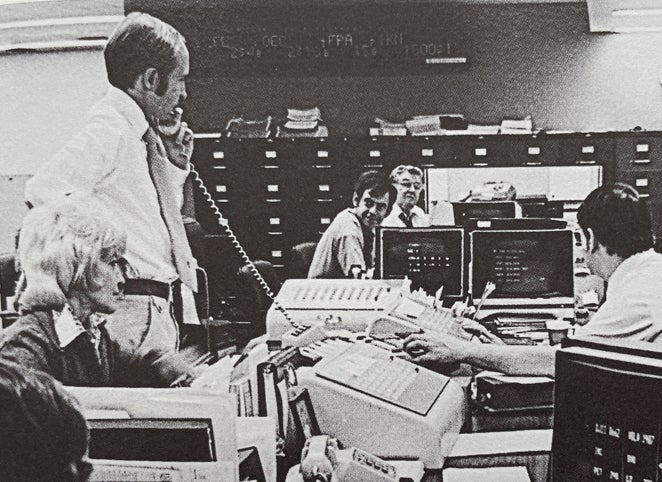

1983

Addison L. Piper succeeds Harry C. Piper Jr. as chief executive officer. Forbes lists Piper Jaffray Incorporated, the holding company for Piper Jaffray & Hopwood, as one of the best “small companies” in the U.S.

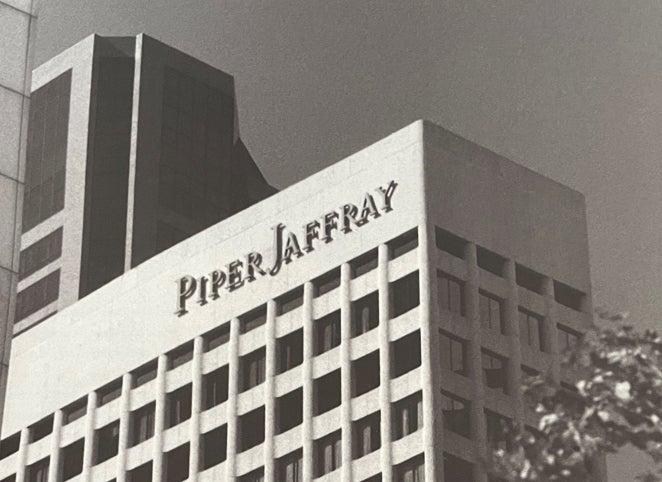

1985

The company moves to a building bearing its own name and striking an impressive silhouette on the Minneapolis landscape: the Piper Jaffray Tower.

1986

Common stock of Piper Jaffray begins trading on NASDAQ under the symbol PIPR.

1992

The name of the broker-dealer changes from Piper Jaffray & Hopwood Incorporated to Piper Jaffray Inc.

1993

The Piper Jaffray Companies Foundation is established and allocates $3.4 million to charitable organizations in its first year.

1998

Piper Jaffray is acquired by U.S. Bancorp in a cash transaction valued at $730 million.

1999

The company changes its name to U.S. Bancorp Piper Jaffray to reflect its partnership.

2000

The company moves its headquarters to 800 Nicollet Mall in Minneapolis. The firm now has more than 125 retail offices in 18 Midwest, Mountain and Western states.

2001

Milwaukee-based Firstar Inc. acquires U.S. Bancorp, giving way to the eighth largest financial services organization with $170 billion in assets. The new entity retains the U.S. Bancorp name.

2003

Piper Jaffray becomes an independent, publicly held company following its spin-off from U.S. Bancorp. Stock begins trading again on the NYSE under the symbol PJC.

2004

Piper Jaffray acquires Vie Securities, LLC, a leading provider of algorithm-based, electronic execution services. The firm now offers new proprietary algorithm-based trading capability as part of its broader, client-focused equity trading platform.

2006

Private client services division is sold to UBS Financial Services, allowing Piper Jaffray to redirect business strategy toward building a leading investment bank.

2007

Piper Jaffray completes acquisition of FAMCO to expand asset management capabilities.

2007

Piper Jaffray completes acquisition of Hong Kong-based investment bank, Goldbond Capital Holdings Limited.

2010

Piper Jaffray acquires Advisory Research, Inc., an asset management firm mainly focused in equity strategies, as a stable complement to its more cyclical global capital markets business.

2013

Piper Jaffray acquires Seattle-Northwest Securities Corporation significantly expanding the firm’s municipal business. Piper Jaffray acquires Edgeview Partners, L.P., a middle-market M&A boutique. Piper Jaffray adds a consumer industry team.

2015

Piper Jaffray acquires River Branch Holdings, bolstering its sector coverage in financial institutions, and grows its fixed income services group with the acquisition of BMO Capital Markets GKST.

2016

Piper Jaffray acquires Simmons & Company International, an energy investment bank, creating our second largest investment banking franchise.

2019

Piper Jaffray acquires Weeden & Co., L.P., a leading equity trading firm, almost doubling equities revenue. Piper Jaffray sells the remaining business of Advisory Research, Inc., resulting in the firm exiting its traditional asset management business.

2020

Piper Jaffray acquires Sandler O’Neill + Partners, the leading financial services investment bank; the combined firm is named Piper Sandler Companies. Piper Sandler acquires The Valence Group and adds sector coverage in chemicals & materials. Piper Sandler acquires restructuring team with addition of TRS Advisors.

2022

Piper Sandler acquires Cornerstone Macro, adding macro research to the platform. Piper Sandler acquires Stamford Partners LLC, a European consumer M&A boutique. Piper Sandler completes acquisition of DBO Partners, bolstering its technology investment banking platform.

2024

Piper Sandler acquires Aviditi Advisors, forming the private capital advisory group. This adds premier fundraising, secondary solutions and direct investment capital capabilities to the firm’s market-leading private equity M&A and capital markets franchises.

2025

Piper Sandler acquires government services and defense technology M&A boutique, G Squared Capital Partners. The company moves its headquarters to 350 North 5th Street in Minneapolis. The firm now has more than 60 offices across the U.S. and in London, Aberdeen, Zurich, Munich and Hong Kong.